How Much Taxes You Will Pay on a $64,000 Salary in NYC

There's a lot of taxes to pay if you live in NYC.

New York State makes the list for the top 10 states in the United States for the highest income taxes.

This article assumes that you are single or married and filing separately. It also assumes 1 dependent (yourself) on a W2 form.

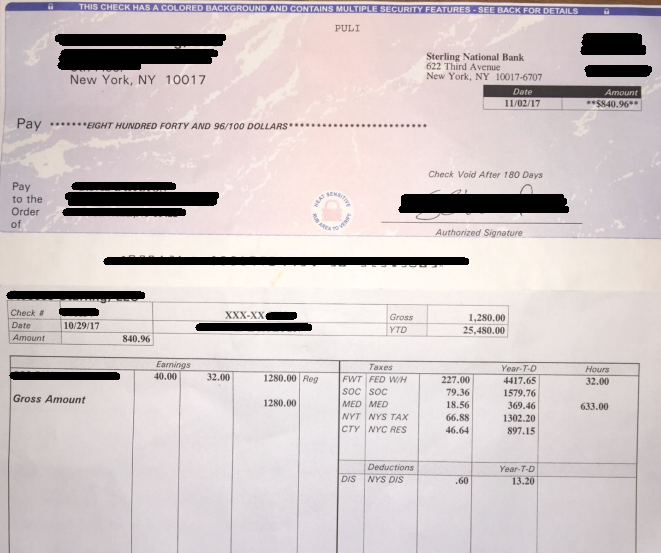

If you make a salary of $64,000, after taxes, you will make either $840.96 if you are paid weekly or $1681.92 (if you are paid biweekly).

This is summarized in the table below.

| NYC Paycheck for $64,000 | |

| Earnings | $840.96 (if paid weekly) or $1681.92 (if paid biweekly) |

| Federal taxes | $227.00 (weekly) or $454 (biweekly) |

| Social security tax | $79.36 (weekly) or $158.72 (biweekly) |

| Medicare tax | $18.56 (weekly) or $37.12 (biweekly) |

| NYS tax | $66.88 (weekly) or 133.76 (biweekly) |

| NYC tax | $46.64 (weekly) or $93.28 (biweekly) |

Below is an image of an actual paycheck issued in NYC for a weekly salary of $64,000.

If you live in NYS, the taxation is shown in the table below.

| NYS Taxes | |

| Single or married and filing separately | |

| Income | Tax |

| $0-$17,050 | 4% |

| $17,050-$23,450 | $682 plus 4.5% over $17,050 |

| $23,450-$27,750 | $970 plus 5.25% over $23,450 |

| $27,750-$42,750 | $1,196 plus 5.9% over $27,750 |

| $42,750-$160,500 | $2,081 plus 6.45% over $42,750 |

| $160,500-$321,050 | $9,676 plus 6.85% over $160,500 |

| $321,050-$2,140,900 | $20,352 plus 6.85% over $31,050 |

| $2,140,900 & up | $145,012 plus 8.82% over $2,140,900 |

For a salary between $42,750 and $160,500 in New York State, you have to pay $2,081 plus 6.45% of any amount over $42,750.

If you live in NYC, the taxation is shown as in the table below.

| NYC Taxes | |

| Single or married and filing separately | |

| Income | Tax |

| $0-$12,000 | 2.907% |

| $12,000-$25,000 | $628 plus 3.534% over $21,600 |

| $25,001-$50,000 | $1,455 plus 3.591% over $25,000 |

| $50,001-$500,000 | $1,706 plus 3.648% over $50,000 |

| $500,001 & up | $19,255 plus 3.876% over $500,000 |

So, for a salary between $50,000 and $500,000, you have to pay $1,706 in NYC taxes and 3.648% of any amount over $50,000.

So combining both state and city taxes for a salary of $64,000 yields a 10.098% tax rate for state and city taxes.

Of course, we haven't yet gotten into federal taxes, social security, or medicaid, which take even larger portions of your check away.

So let's now venture into those.

So the federal tax rate is progressive, meaning that as you make more income, you go into higher tax brackets. The United States currently (as of 2017) has 7 tax brackets for federal income tax: 10%, 15%, 25%, 28%, 33%, 35%, and 39.6%.

The following table summarizes the federal tax bracket.

| Single or Married and Filing Separately | ||

| Tax Rate | Taxable Income Bracket | Tax Owed |

| 10% | $0-$9,325 | 10% |

| 15% | $9,325-$37,950 | $932.50 plus 15% over $9,325 |

| 25% | $37,950-$91,900 | $5,226.25 plus 25% over $37,950 |

| 28% | $91,900-$191,650 | $18,713.75 plus 28% over $91,900 |

| 33% | $191,650-$416,700 | $46,643.75 plus 33% over $191,650 |

| 35% | $416,700-$418,400 | $120,910.25 plus 35% over $416,700 |

| 39.6% | $418,400 | $121,505.25 plus 39.6% over $418,400 |

So, for a salary of $64,000, you would have to pay $5,226.25 plus 25% of any amount over $37,950.

Social security tax and Medicare tax are much more straightforward than state, city, and federal taxes. There is just one flat rate. Social security tax is really 12.4%. However, your employer pays 6.2% of it. So the remaining 6.2% is taken from your check. So only 6.2% is taken from your check. So, if you make a salary of $64,000, you make $1280 a week or $2560 biweekly. For the $1280 weekly check, your social security tax will be $79.36 ($1280 x 6.2%). For a biweekly check, the social security will be $158.72.

Medicare tax is really 2.9%. However, just like with social security, your employer pays half, which is 1.4%. Therefore, only the remaining 1.45% is taken from your paycheck. So, if you make a salary of $64,000, you make $1280 a week or $2560 biweekly. For the $1280 weekly check, your Medicare tax will be $18.56 ($1280 x 6.2%). For a biweekly check, the medicaid will be $37.12.

And this concludes all of the taxes you would pay if you live in New York City.